Wednesday 3 February, 2021

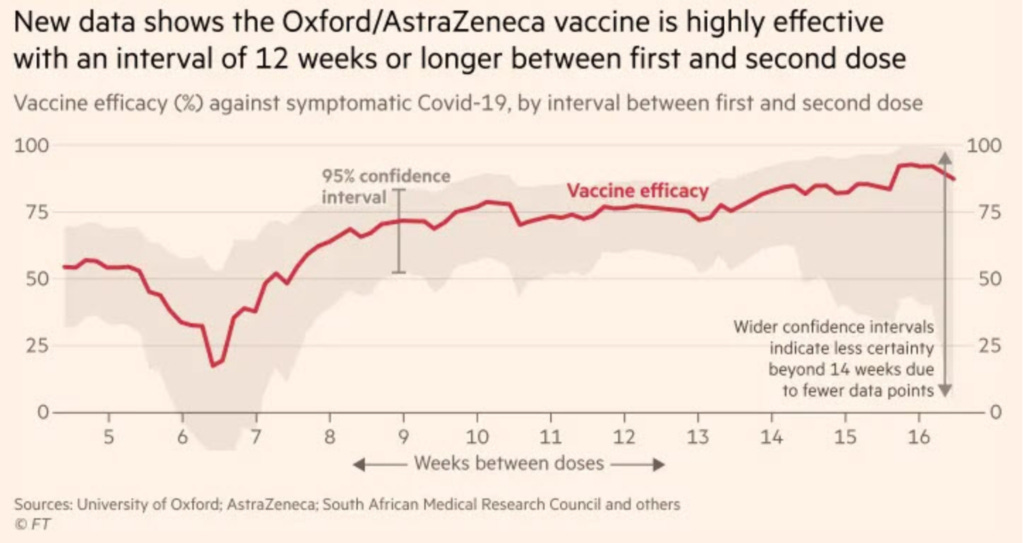

Forgive me if I find this chart particularly interesting. This is the vaccine I had on January 30.

Alex Tabarrok has a useful commentary on it.

Quote of the Day

”In 1969 I published a small book on Humility. It was a pioneering work which has not, to my knowledge, been superseded.”

Lord Longford (known to the British tabloids as ‘Lord Porn’ because of his campaign to stamp out pornography).

Musical alternative to the morning’s radio news Mary Bergin with Tony Linnane and Mick Conneely | Three reels

The reels are The Banks of the Ilen, The Scartaglen and The Belles of Tipperary

Mary Bergin is an extraordinary musician who works magic with the simplest instrument imaginable.

Long Read of the Day

The Science of reasoning with unreasonable people

By Adam Grant, who teaches organisational psychology at Wharton. (Trump’s alma mater, by the way. Not that that’s anything to do with anything.)

TL;DR summary: Don’t try to change someone else’s mind. Instead, help them find their own motivation to change. Link

I found it interesting but not entirely convincing. Maybe I’m just being unreasonable!

Game On: the GameStop saga, contd.

It gets more and more interesting. For example…

1 – Nicholas Colin had a go at it in his weekly newsletter:

Everyone Wants To Be a Capitalist

The one thing I’m quite sure of regarding the GameStop story is that we haven’t seen the end of it yet. One reason why is because it has been driven (even without falling into the facile idea of “little guys vs. hedge funds”, which has been pretty well shown to not be the case) by the ‘multitude’: those billions of networked individuals who can now exert power in the Entrepreneurial Age.

It shouldn’t be a surprise that many members of the multitude were drawn towards trading over the past year. After all, while much of the world’s market economy has been effectively halted by COVID-19, it’s been only too evident that the capitalist side of things has been doing quite well. That left a ripe environment for what my friend Martin Gurri calls “The Revolt of the Public” to make its way to the heart of Wall Street (which, as it turns out, is located less in Zuccotti Park and more in Bloomberg terminals 😉).

In the end, it’s not simply that barriers to information have been taken away. It’s that without those barriers, the multitude is able to coordinate in ways that were never before possible. It’s no guarantee that ‘the people’ will win against hedge funds; but at the very least, it’s a guarantee that there’s a new player in the game who must be accounted for.

And it is a game.

2 – Linsey McGoey in the LRB joined in with an interesting post which started with Alexis de Tocqueville and George Sand in 1848 and eventually got to GameStop:

It may sound like a classic case of David v. Goliath, but that’s not the whole story. The WSB players on Reddit are not all small-scale. One post noted drily that one of the moderators of the forum used to be Martin Shkreli, a notorious ‘pharma bro’ who has drawn rage over the years for price-gouging on lifesaving medicines. According to this version, it isn’t exactly a good guys v. bad guys story. It’s more about less bad guys ripping off worse guys – all the while exposing the most naive investors to heavy losses which they can’t afford.

Yes and no. Behind Shkreli, there are legions of other men and women with different and even noble agendas.

We don’t yet know what the regulatory ramifications of GameStop will be. Nor do we know its emancipatory potential, its capacity to level the market aristocracy. Years ago, old-guard leftists would scoff at the idea of ‘socialist hedge fund’, dedicated to buying up distressed debt and cancelling it, or using the profits for a strike fund. Now such ideas are on the table, embraced by a new generation who know all too well how powerful and rigged the market really is.

When it comes to the great financial ‘casino’, as Susan Strange dubbed it in 1986, today’s young are tired of being manhandled like plastic chips, scattered by ‘invisible hands’ that may be hard to see, but are clearly good at hoarding. It would be prudent not to underestimate the young. The chips have eyes, they can see the market is rigged, and they are taking notes on its vulnerabilities.

For decades, powerful hedge funds have derailed post-Depression financial reforms, while private equity buccaneers dodge the levels of income tax that any mid-level office or health worker pays. The market is not a democracy, it’s feudalism, and the lords expect subservience from well-pampered regulators.

With GameStop, we don’t know, and will probably never know, who threw the first stone. Maybe it was someone like Shkreli, or maybe it was a young girl, pulling an even faster one. And why not?

3 – Which provoked this lovely Comment by P Eluard:

An interesting factor that plays into your argument has been the blatant double standard of treatment when it came to how retail investors (like me, and potentially anyone else with a smartphone and a bank account) were treated relative to the hedge funds and legacy financial institutions. The platforms which are the big new thing in this series of events, like the ‘robinhood’ app in the US or the ‘freetrade’ app in the UK (which I piled in on as soon as I heard about what was going on, inveterate redditor here) were forced by their guiding institutions to limit the buying power of their users during the squeeze. They said this was to protect their users from volatility. Robinhood has a stakeholder of some sort in Melvin capital, the hedge fund that lost 53% of its value in January. So people were rather surprised when they finally seemed to have the chance to ‘steal from the rich, and give to the poor’, and found that actually they were dealing with the sheriff of Nottingham the whole time, the truth being in the small print.

After sinking a very small sum I could afford to lose into GME stocks on freetrade, I was surprised to wake up on friday and find my trade wouldn’t be quite as free as I thought, and I wouldn’t be able to buy any more, due to their American partner institution declining to offer any American stocks for buying and selling on Friday. The story is that, due to the massive volume of trading that happened on Thursday when the first peak was reached in the price, the clearing house raised the amount that the platforms would have to put up to process the purchase. The clearing houses being unable to process purchases was a key fact in the 2008 crash, I believe (feel free anyone to correct me.) So that’s a justification. But, limiting the buying power of retail investors allowed the institutions, free of limitations, to cover their losses over the next couple of days, as the upwards momentum was drained, and the retail investors left confused as to why their stellar peaks never arrived. Still, seeing billionaires panicking about how much money they were losing and blaming their extremely stupid gambling losses on the poor hating the rich was payment enough for some. I had a blast.

This one will run and run. Or should that be ruin and ruin?

I agree with Nicholas Colin: what this caper has usefully revealed (to those who didn’t know it) is that the stock market (especially the US one) is indeed a game. The thing about Robinhood, Freetrade & Co is that they reduce the friction for small players to get into the game. In the process, they have also introduced some interesting new dynamics into it.

What the Woke Don’t Get About the Old

Nice essay by Sahil Handa

If you’re young like me, you have heard that putdown for our elders, “OK, boomer.” But perhaps also like me, you’ve been a little confused by what it meant. According to an explanation on Vox, “the older generation misunderstands millennial and Gen Z culture and politics so fundamentally that years of condescension and misrepresentation have led to this pointedly terse rebuttal.” Urban Dictionary is more direct, describing “OK, boomer” as “a simple way to tell old people to fuck off.”

What both sources miss is that “OK, boomer” says more about our generation than theirs.

I tend to dislike analysis of generations, partly because I do not feel any particular tie to my own. I was always the kid who liked to spend time with adults. Most of my cousins are twice my age, and I spent my first 16 years trying to be considered their equal. I hated when the parents would sit in a separate room, and leave the kids to play videogames: I was desperate to be taken seriously.

But aged 22 now, I see that the current generational stereotyping isn’t just the old frowning at the young, but my generation frowning at the old. According to the idea prevalent among young progressives, old liberals are self-indulgent and morally compromised. Their use of words like “civility” and “patience” is nothing but a way to preserve the status quo. They are transphobic, complacent about the climate, and make a habit of glossing over Western atrocities. And they do it all with a smug smile (while stockpiling cash from the youngsters who need it).

It’s a nice piece, worth reading in full. He also has a companion essay “What the Old don’t get about the Woke”.

I do hate that term “Woke”, though. Can’t we think of a more elegant one?

Other, hopefully interesting, links

Robert Caro interviews Kurt Vonnegut. Unmissable. Often, it’s not clear who’s interviewing whom. Link

Jeff Bezos’s email to Amazon employees. Link

Google Cloud lost $5.6B in 2020. No wonder Jeff Bezos was grinning today. Link